Starting Home towards Hustle: Perfecting Insurance for Motor Trades

The emergence of remote work has transformed many industries, and the vehicle trade is no exception. With the flexibility of operating from home, more people are taking their car sales and repair operations online. However, as thrilling as this shift can be, it also introduces new issues, particularly in the area of insurance. Comprehending motor trade insurance is crucial for individuals looking to thrive in this changing environment.

Motor trade insurance delivers a security blanket for those engaged in the acquiring, selling, and maintenance of cars. When functioning from home, it becomes consistently important to make certain that you have the suitable protection in place. This kind of insurance protects you from a range of perils, from theft to accidents, and offers tranquility as you navigate your motor trade business from the convenience of your home. In motor trade insurance working from home , we will examine the ins and outs of motor trade insurance and how you can excel at it to efficiently enhance your home-based hustle.

Understanding Vehicle Trade Coverage

Vehicle trade coverage is crucial for people and companies involved in the buying, commerce, or maintenance of automobiles. Differing from standard car coverage, this kind of coverage caters exclusively to the requirements of motor dealers, delivering coverage for automobiles under their care and enabling them to conduct business within the law. It pertains to different professions within the trade, including automobile merchants, service specialists, and collision centers, guaranteeing that their business activities are protected.

One key aspect of motor trade insurance is the versatility it gives. Policies can be adapted to meet the individual demands of the motor trader, covering everything from accountability to harm to automobiles in their possession. This adaptability is especially helpful for those conducting business from home, as they can select insurance that aligns with their unique operational model. Whether handling with multiple automobiles on-site or managing a smaller selection, appropriate protection is crucial.

Working from a home office brings its own set of difficulties and advantages for motor dealers. It provides for reduced overhead costs and a more personalized approach to customer service. However, it is important to comprehend the consequences for insurance, as residential operations may require different insurance terms than conventional auto dealers. By ensuring thorough motor trade coverage, operators can shield their holdings and focus on developing their operational activities without the worry of unforeseen circumstances.

Types of Motor Trade Insurance

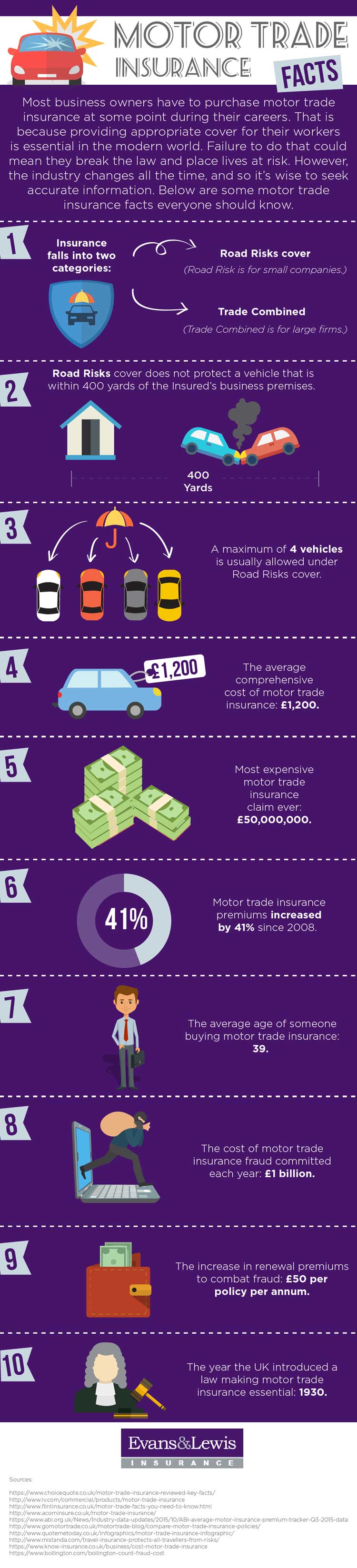

Motor trade insurance is crucial for those operating in the motor sector, including a vehicle seller, mechanic, or a car trader. There are several types specifically crafted to cater to specific business needs. The most prevalent types include road risk insurance, which protects vehicles employed by the business while their road. This protection is vital for those who drive cars or transport them from one place to another, making certain that all regulatory requirements are met.

A further category is combined automotive insurance, which integrates multiple types of coverage into one policy. This often encompasses business premises insurance, liability insurance, and stock insurance. These combined plans are particularly advantageous for individuals running a larger operation from home, as they provide all-encompassing coverage for the company's assets and responsibilities. The flexibility of combined policies allows motor traders to customize their coverage based on their specific operations and risks.

In conclusion, liability insurance is a critical component of motor trade insurance, safeguarding businesses against lawsuits arising from accidents or injuries that happen as a consequence of their operations. This can include general liability and employer's liability insurance. For home-based traders, having appropriate liability insurance protects them from possible lawsuits and ensures just in case something goes wrong, their business can remain solvent. Grasping these types of motor trade insurance is crucial to selecting the right coverage for a home-based trading operation.

Tips for Choosing the Right Policy

In the process of selecting motor trade insurance for your at-home business, it's crucial to assess the specific needs of your operations. Consider factors such as the size of your business, the types of vehicles you manage, and the activities you conduct, whether it's selling, fixing, or maintaining vehicles. A tailored policy will not only cover your business activities but also protect against possible risks unique to your operations.

Another key aspect is understanding the protection options available. Look for policies that offer comprehensive protection, including external liability, damage to vehicles, and coverage for tools and gear. Ensure you have clarity on exclusions and limits of liability, as these can significantly impact your financial security in the event of a claim. Comparing quotes from different providers can help ensure you find a balance among sufficient coverage and affordability.

Lastly, consider the standing and customer service of the insurance provider. Research online reviews and ratings to gauge the experiences of other automotive businesses. A attentive and knowledgeable insurer can make a huge difference in the claims process, ensuring that you receive the support you need when it matters most. Make it a priority to working with a provider that understands the unique challenges of the motor trade sector and can offer professional guidance on your insurance needs.